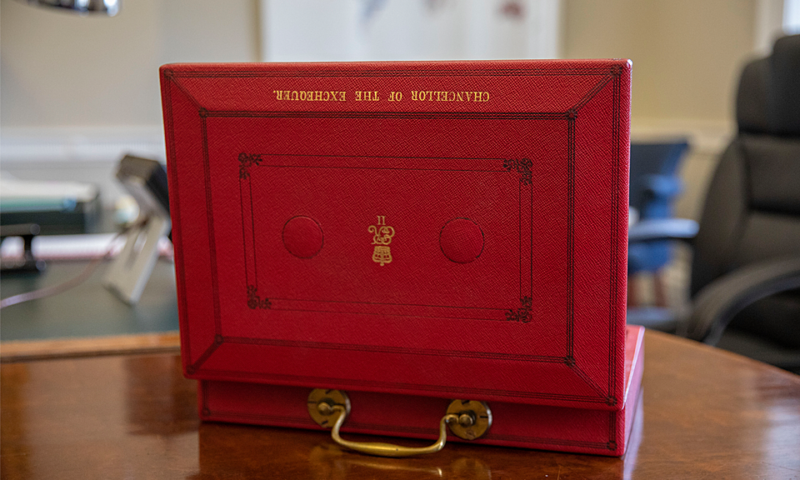

The Chancellor of the Exchequer, Jeremy Hunt, presented the Spring Budget to the House of Commons today. It addresses the economic priorities that the Prime Minister announced earlier this year, namely halving inflation, growing the economy and reducing public debt.

Jeremy Hunt said: “Our plan is working – inflation is falling, debt is falling and the economy is growing… Today we are announcing the next stage of our plan: a budget for growth. That’s what I’m doing today by removing the barriers to business investment, tackling the labour shortages that prevent them from hiring, breaking down the barriers that prevent people from working and harnessing British ingenuity to make us a science and technology superpower.”

The economic framework

The Office for Budget Responsibility (OBR) forecasts growth of -0.2% this year, with no recession in the technical sense, 1.8% in 2024 and 2.5% in 2025. Inflation would average 6.1% this year, 0.9% in 2024 and 0.1% in 2025. Unemployment would peak at 4.4% in 2024 compared to 4.1% this year.

Public debt would rise gradually over the next four years to 94.8% of GDP in 2026-27, up from 92.4% in 2023-24, before falling from 2027-28 – in line with the government’s fiscal rule. However, the medium-term debt path would be around three percentage points of GDP lower than projected in November.

The main announcements

Additional measures to support purchasing power

– Extension for three months of the “Energy Price Guarantee” mechanism for capping household energy bills. This means that the average energy bill for a typical household will remain capped at £2,500 until the end of June, rather than the £3,000 it should have been from April. This extension represents an additional £160 of support per household

– Removing a charge on households using pre-payment energy meters, saving four million families £45 a year

– Freezing fuel taxes for the next twelve months

In total, the package of spending power measures announced in recent months will amount to £3,300 per household in 2022-23 and 2023-24 at a total cost of £94 billion – one of the largest support packages in Europe.

A comprehensive back-to-work plan

– Pension tax reform to encourage skilled workers, such as doctors, to stay in work longer

– A new voluntary universal support programme for people with disabilities and health problems to help them into work

– A White Paper on reforming disability benefits to better meet their needs

– Reform of training programmes to make them more accessible to the over-50s

– Tougher sanctions against those who fail to take up reasonable job offers

– A £406 million plan to tackle the major health causes that keep people out of work, with targeted investment in specialist services for mental health, musculoskeletal disorders and cardiovascular disease

Tax measures for businesses

– A transformation of capital allowances representing a £27 billion tax cut over three years to support business investment. This tax cut will be 25 pence for every pound invested in plant and machinery

– Research tax credits will be boosted by £500 million a year to support 20,000 R&D intensive businesses

– More generous tax credits for the audiovisual sector (film, television, video games). The 45-50% tax credits for theatres, orchestras and museums will remain in place until 2025

Economic Levelling Up

– An additional £8.8 billion of funding for regional transport over five years

– 200 million will be invested in regeneration projects across the UK

– 400 million will be spent on levelling up partnerships in the regions. A new tranche of the Levelling Up Fund will be dedicated to communities

– 12 new investment areas

Zero Energy Net

– 20 billion pounds will be spent on carbon capture and storage initiatives, contributing to the 2050 net zero target

– The creation of Great British Nuclear to ensure the UK’s energy resilience and security, enable nuclear projects (including small modular reactors), support the UK nuclear industry and provide investment opportunities. Nuclear power will be included in the green taxonomy, depending on the consultation

Childcare

– Additional support for households on Universal Credit who return to work to help with childcare costs. Thirty hours of free childcare will also be available by September 2025 for all children aged between nine months and three years whose parents are in work

– raising the tax threshold from £10,000 to £18,000 for home carers

– in recognition of the importance of childminders and the shortage of professional childminders, incentives of £600 (and £1,200 for those working through an agency) will be available from this autumn for those entering the profession in order to increase the number of professional childminders and offer parents more choice

Technology

– Smart regulation for digital technologies: the government will take on board all the recommendations of the mission led by Sir Patrick Vallance

– 900 million pounds of funding for research into artificial intelligence and an exascale computer, and a commitment of 2.5 billion pounds to a ten-year programme of quantum research and innovation as part of the Government’s Quantum Strategy.

Please find below:

- Jeremy Hunt’s speech: https://www.gov.uk/government/speeches/spring-budget-2023-speech

- the documents: https://www.gov.uk/government/publications/spring-budget-2023

- the Office for Budget Responsibility’s macroeconomic framework: https://obr.uk/docs/dlm_uploads/OBR-EFO-March-2023_Web_Accessible.pdf